top of page

Chartered Accountants

Feb 12, 20250 min read

Chartered Accountants

Feb 4, 20250 min read

Monthly Newsletter

📒Stay Updated with Our Comprehensive Newsletter! We are excited to share our latest Newsletter covering key updates on legal...

Chartered Accountants

Jan 20, 20251 min read

Chartered Accountants

Sep 27, 20240 min read

Expert Guidance on Unified Pension System (UPS) – Mr. JB Mahapatra

We are honored to have Mr. JB Mahapatra as our esteemed advisor. His expert insights into the recent Cabinet decision on the Unified...

Chartered Accountants

Sep 24, 20241 min read

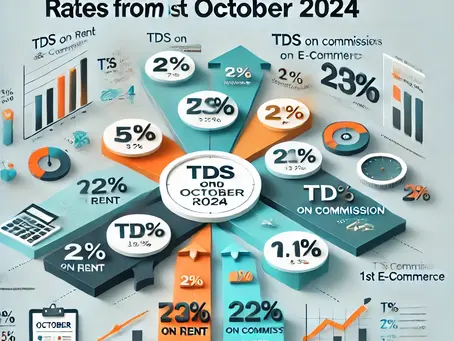

Major Changes in TDS and TCS Rates from 1st October 2024

The Finance Act (No. 2), 2024 introduces significant changes in the Tax Deducted at Source (TDS) and Tax Collected at Source (TCS) rates...

Chartered Accountants

Sep 16, 20242 min read

E-Invoicing with the Updated GSTN QR Code Scanner Mobile App

The Goods and Services Tax Network (GSTN) has made a significant update to its QR Code Scanner Mobile App, aimed at improving the...

Chartered Accountants

Sep 13, 20242 min read

GST Council Approves Amnesty Scheme for Tax Demands u/s 73 for 2017-18, 2018-19, and 2019-20

In a significant move aimed at easing the compliance burden on taxpayers, the GST Council has approved an Amnesty Scheme for taxpayers...

Chartered Accountants

Sep 11, 20243 min read

The Upcoming Mandate on E-Invoicing for B2C Transactions: What Businesses Should Expect

The Goods and Services Tax (GST) Council is preparing to extend the e-invoicing mandate to include business-to-consumer (B2C)...

Chartered Accountants

Sep 7, 20242 min read

GST Registration Cancellation is Independent of Pending Liabilities

Cancellation of GST registration cannot be denied based on pending dues, clarifies Delhi High Court. Delhi High Court Clarifies Grounds...

Chartered Accountants

Sep 6, 20242 min read

Chartered Accountants

Sep 6, 20240 min read

bottom of page